Startups bring back to the market, because the market rebound

Mumbai: After a lull lasting 4-5 months, IPO can open to window startups and may be a wide set of companies between bounce in local markets and relative relatives of global geopolitical stresses. The firms have started active discussion on the listing and are intensifying IPO filing to make most of the time, investment bankers told TOI. Firms such as firms like Ather Energy, after re -reading the size and assessment of their issue to get more investor participation among a weak market, are feeling more confident in determining the expectations of even more confidence and even more confident. According to data shared by IIFL Capital, more than 80 companies are in different stages of approval for IPOs, about a quarter of which are in areas of new era. “Recently with signs of progress between the US and China on ceasefire and tariffs, (market) tone has become more creative. It is reflected in the strength of last week’s block deals, which were well absorbed by the market. Kailash Soni, head of India Equity Capital Markets (ECM) at Goldman Sachs, said, “We are more actively looking at the primary issuance to take advantage of the current window.Not to say that the IPO will immediately have a hurry that the IPO takes longer to launch but the speed is back.

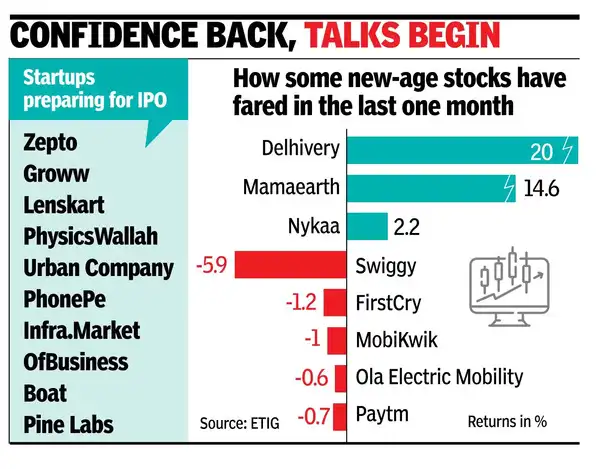

Sony said, “The stability we are now seeing has certainly renewed interest, we (calendar) expects to see meaningful activity in the second part of the year, especially from companies who had planned earlier.” In the end of September 2024, Sensx, the all -time high of the scar of about 86k, lost from about 15% to 73K earlier this year. Since then it has been received, with intermittent mantras of high volatility, now up to 82k levels, about eight months ago about 4% below the high level of its lifetime.Companies like LG Electronics’ India Arm stopped IPO plans amidst market volatility.Zepto, Pinalabs, Lenskart, Growww and PhonePe are among the startups that are preparing for the IPO, while some people like urban company and physics have already filed their draft IPO paper with SEBI.“Many new age companies are accelerating the filing of DRHPS. If the market remains stable, we will look at more new age firms that launch IPOs this year than traditional companies. Now the market mode is at risk,” Gaurav Sood, Managing Director and Head of ECM at Avendas Capital.