Top Stories

Is there an American recession coming? Answers to 5 major questions

The American economy can go to some season – and when America slows down, the world feels that shocks. Trump Tariffs put global trade under pressure and India was closely tied to both the US and China, a potential downturn in the US, a very least, can slow down the growth rate in India.What are economists and investors saying here:

Answers to 5 major questions

1. How close are we close to recession?

Five agencies and experts say:

| agency | Major reason |

|---|---|

| The Special Economic Index of the Conference Board (LEI) has declined at least 15 out of the last 18 months; The board says that a “important development recession” is cooked, although a complete recession is still not a matter of case. | Weakness in construction of new orders, consumer expectations and building permit |

| Reuters Economists Polls of April 7 put the average possibility of recession in the next 12 months at 45% – the highest since December 2023 | Tariffs are already shaving 0.8 percentage points from 2025 GDP forecasts; Trade spirit and capex plans fall |

| In March 2025, Moody’s Analytics’ Mark Zandi kept the recession barriers in podcast at 40% till the end -2025 | Tariffs, Evading Fiscal impulses, and tight credit standards |

| John authors of the Bloomberg Opinion say the possibility of the 2008 style policy mistake is increasing; Warns “It’s best not to wait for Nber confirmation” | 15 months slide leading economic index in conference board, tariff shock to supply chain, and a deep reverse 2-10 years Treasury curve |

| Ray Delio, founder Bridgwatter Associates, has stated that the US is “very close to a recession, saying” Tariff “prefers to throw rocks in the production system” and if worse than the recession can be worse then “worse than the recession can be worse”. | Tariff Shock Cripping is the supply-chain efficiency; American combines with a balloon of debt, “breaks of monetary order,” and intensifies a geopolitical conflict – the conditions, dalio, says darpan in the 1930s |

2. American slowdown since 2000

| Recession | braid | Trough | Period (month) | Real GDP peak-to-trap | Peak unemployment |

|---|---|---|---|---|---|

| Dot-Com / 9-11 | March 2001 | November 2001 | 8 | -0.3% | 5.7% |

| Great recession | December 2007 | June 2009 | 18 | -4.0% | 10.0% |

| Kovid -19 recession | February 2020 | April 2020 | 2 (shortest on record) | -19.2% (Q/Q Annual Q2) | 14.7% |

3. Can US recession trigger global recession?

The American recession can go globally when they coincide with a systemic financial blow (2008) or an external event (epidemic). Otherwise, spill-overs are exposed. The IMF has denied a global recession.

- 2001 US recession There was no global reason. World GDP increased by 2.5%, but trade growth collapsed.

- 2007–09 There was a US and global recession-global contraction after war (~ 1.3% World GDP ’09)

- 2020 Kovid Lockdown pushed world GDP below ~ 3%, deepening since 1945

4. China and India recession since 2000

Lump sum GDP contraction period (last 25 years)

China

- Q1 2020 (-6.8% y/y) – first contraction after 1976

Note: Annual growth still +2.2%for 2020; 2022 growth just 3% (worst outside 2020)

India

- FY 2020-21 (-7.3%, with -24% in April-June 2020); RBI classified H1 FY21 as “technical recession”

Note: Previous Near-Relations

- 1991 Balance-Off-Payments Crisis (Real GDP +1%)

- 2008-09 Recession (Development fell to 3.1%, but positive)

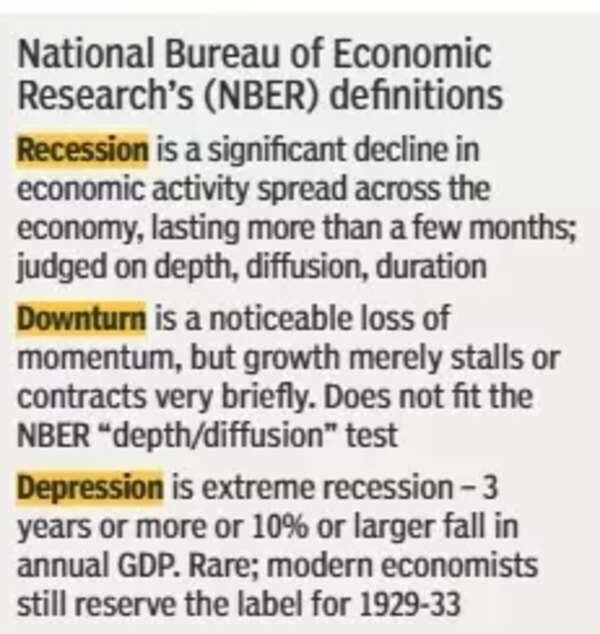

5. Why is a recession in India different from one in America

| Dimensions | United States | India |

|---|---|---|

| Common nature of primary shock | Financial cycle and consumer credit (housing, credit card); Inventory cycle | Supply-party shock (oil, monsoon), external capital flow, demand for informal sector |

| Stable factor | Big: Unemployment Insurance, Reduce Progressive Tax Hit | Small; Informal Employment> 45% access to socio-protection |

| Monetary policy pass-through | Fast: Deep Bond Market, Horticulture Refinance | Slower; Bank-LED system, high part of small firms outside formal credit |

| Job and wages | Unemployment increases rapidly but cushion benefits income | Job losses push workers back into agriculture/informalism, disappoints less for unemployment rate. |

| Global spillover | An US recession tightens global financial conditions through dollar funding and risk | An Indian recession is mainly attracted to the demand for regional trade, dispatch and commodity; Financial fingering by capital control |