Borrowing, child, credit: borrowers are getting smaller

Mumbai: When HDFC offered a home loan in the late 1970s, the credit was a privilege, carefully and late in life. A major downpayment was a condition, and only in the 40s, which could usually risk borrowing, with years of savings.Today, the credit is accessed long ago and more carelessly, with the increasing number of Indians begins its credit journey in the mid -20s.

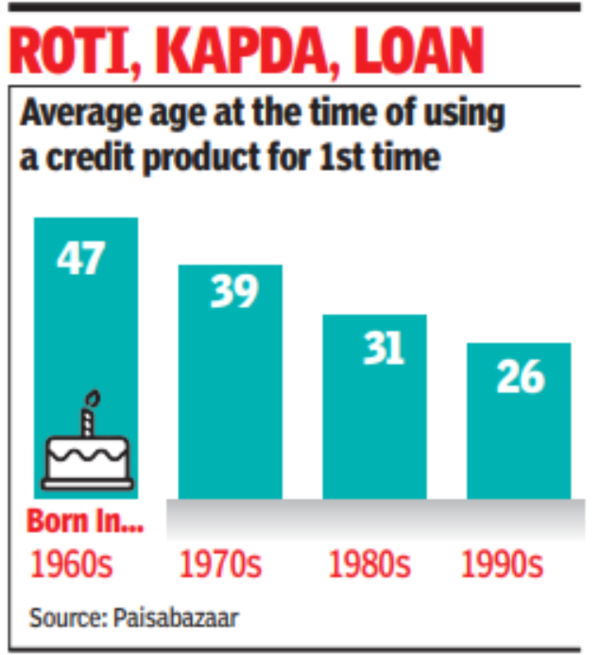

The average age on which Indians take advantage of their first credit product have fallen for 21 years in three generations, a study by Pisabazar has shown. The Cherian Varghese, the former chairman of the Corporation Bank, who started his banking career five decades ago, says the borrowing ability is directly associated with the size of the disposable income. “Personal loans are taken to purchase either home loan or some assets for consumption. In the 70s, disposable income loan was not enough to serve EMI. Today, in many jobs, employees get a decent salary that allows them to fulfill all expenses and repay their EMI,” said Varghese. He says that today banks have pre-exposed many corporate employers and they are ready to provide a suit of credit products to their employees, making credits more accessible.

While the Credit Bureau made it easy for lenders to identify delicts, Jan Dhan-Audhar-Mobile Trinity made it easier to keep an eye on the borrowers. The study, which is based on the credit behavior of more than 10 million consumers, showed that people born in the 1960s began to borrow at the age of 47, through safe loans such as hostage. In contrast, individuals born in the 1990s usually enter credit ecosystems until the age of 25–28, often through unprotected products such as credit cards, individual loans, and consumer durable loans.

This change reflects the widespread trend of easy access to credit and a changing consumer mentality – a one that attaches importance to immediate satisfaction on long -term savings. While the first credit card in India was launched by the Central Bank in the early 80s with a mastercard, it was a very restricted product. The cards were offered large-scale tax-paying high-earners. It was not until the city, SBI and ICICI started presenting the card to a comprehensive audience who raised the cards.

The study shows how the entry point in the credit system has developed. For those born in the 1960s, the home loan was the first credit product. For colleagues of the 1970s and 1980s, auto debt became the preferred initial point, profit at an average age of 39 and 31 respectively. The average age for the first time home loan borrowers has declined from 41 (for those born in the 1970s) to 28 (born in the 1990s).