Four public sector banks cut off borrowing rates after RBI

Mumbai: Banks, led by public sector lenders, have started revising their lending rates after cutting the 50 base point repo rate of RBI. However, for a change, older borrowers may benefit more than new, as banks are likely to twist the spread on home loans, which were already competitive looking for market share.Bank of Baroda has reduced its repo-linked lending rate (RLLR) by 50 basis points from 7 June. The bank’s RLLR is now 8.15%. Punjab National Bank has reduced its MCLR unchanged, effective from June 9, to 8.35%of the 50 basis points cut from June 9. Bank of India has reduced its repo-based lending rate from 50 BPS to 8.35% from 6 June.

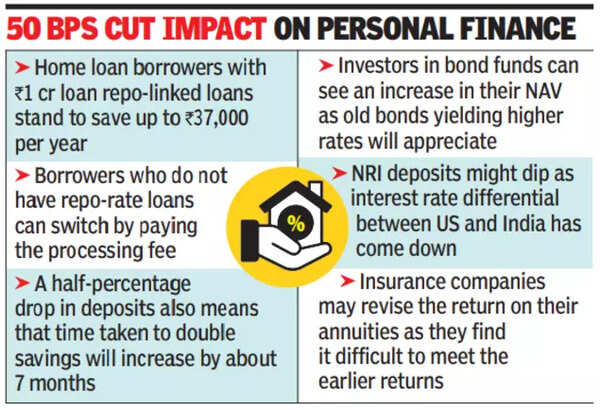

UCO Bank trimmed both its MCLR and RLLR. The bank cut its RLLR from 50 BPS to 8.30% from June 9 and reduced its MCLR in tenure by 10 BPS. Its one year MCLR is now 9%.Meanwhile, HDFC Bank reduced its MCLR by 10 basis points during the tenure, starting from 7 June. With deficiency, overnight and one month rate increased to 8.9%below 10 basis points.According to the RBI criteria, the floating-vet loan should be resetted according to the benchmark repo rate. This means that existing borrowers will see automatic decrease in rates. However, new borrowers cannot get full benefit, as banks are expected to adjust the spreads that they charge at the repo rate to protect the margin. In the case of Bank of Baroda, home loan rates for new borrowers start at 8%after amendment.To preserve profitability, banks are also expected to reduce returns on fixed deposits, especially fresh liquidity is being injected into the system. This can make FDS less attractive to saver.Older borrowers will have more profit than new ones, because due to acute competition, many lenders especially who were challenging market leaders were offering cheap rates. Between public sector banks, Banks of India, Bank of Maharashtra, Central Bank of India and Union Bank of India were giving loans at Rs 7.85% up to Rs 30 lakh even before the cut in rate.Canara Bank, Indian Bank, Indian Overseas Bank and UCO Banks were giving domestic loans at 7.90%, with the rate of Canara applicable for loans above Rs 75 lakh and others for loans up to Rs 30 lakh. Till last week, South Indian Bank had the lowest rate for loans up to Rs 30 lakh at the rate of 8.30% among private lenders in South Indian Bank. Karur Vaiyasya Bank offered 8.45%, while PNB Housing Finance and Tamil Nad Mercantile Bank offered 8.50%. Bandhan Bank, Axis Bank and Karnataka Bank were 8.66%, 8.75%and 8.78%respectively.