Eyes on electronics imports from China

New Delhi: Amid the possibility of an increase in imports from China, the latest data available showed that electronics exports in India, as well as the US, fell in January and February. While these numbers gave comfort to Indian policy makers, the trends after Trump’s tariff functions in recent weeks -as well as a high -level group monitoring, familiar with China with a high -level group monitoring.

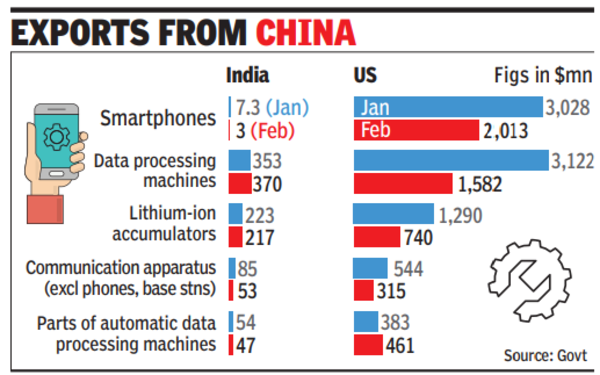

The cost of the top 10 electronics products exported by Chinese companies to India stood at $ 1.8 billion during January and February. US President Donald Trump took over in late January, imported to the US. In January, the Chinese shipment of the top 10 electronics items was estimated at $ 10 billion, falling to $ 6 billion in February. A part of the cause of the decline may be front-loading of exports by China.

China is the largest source of imports for all goods for India as well as America, and both run a large -scale trade deficit, which during the last financial year India’s case was about $ 100 billion and despite the government’s repeated steps, despite keeping it under a check. Electronics, chemicals, steel, consumer durables and other consumer goods are among the top goods being monitored by a committee of officers from Commerce, Revenue and Industry Departments along with other ministries.

The domestic industry and experts raised alarm bells around a possible growth in imports from China and ASEAN, whose many members are seen behind the screen for Beijing, as the supply in the US markets became more expensive with the supply tariffs. However, the full effect of tariff is expected to be kicked only after a few months.

A class of the Indian industry, especially younger players, however, assumes that a lot of fear expressed by big players is unfair. For example, he argued that steel giants created a big noise on a possible import increase from China and worked hard with the government to get 12% security guard duty on multiple products. With duty, he increased prices in the domestic market by 10%. Small players said that there is little possibility of Chinese steel coming into India, given the need for stringent BIS registration, but a bogie was made, which also fell at the government level.