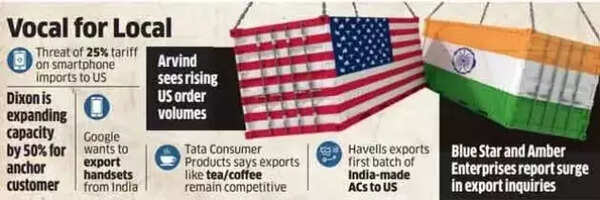

Big Export Boom: India benefits from Donald Trump’s tariff; Indian firms see a competitive status in the American tariff landscape

Donald Trump’s tariff is being seen as competitive positive by Indian firms. Leaders of prominent Indian companies such as Dixon Technologies, Tata Consumer Products, Blue Star, Havells and Arvind have informed analysts that the Indian ventures have a profitable position about American tariffs, with most increased commercial inquiries from their American colleagues.Officials indicated that the ongoing discussion about the Indo-US bilateral trade agreement (BTA) would promote commercial activities.Despite the demand of Trump for local production and 25% tariffs on mobile phone manufacturers like Apple and Samsung, industry analysts suggest that manufacturing in India is more economical for exports.The US tariff deficiency on China has been 145%to 30%, compared to 26%of India’s currently suspended 26%, presenting a positive attitude to top officials. Currently only 10% of American tariffs in India are faced, although the rate of 26% may start again in July.

Vocal

During the recent income call, Dixon Managing Director ATul Lal announced a 50% capacity extension for his primary customer to fulfill the growing orders for his primary customer, mainly for North American exports, given the current geopolitical status. He said that the production for a major American brand through the Complete Partnership, “will increase” with possible export opportunities “.Also read ‘Will not discuss …’: The US tells the WTO that India has no basis for implementing anti -retaliation on 29 American products.Although Lal did not name specific brands, analysts identified Motorola as their primary customer, exporting mobile phones in the US, while the US brand mentions Google’s pixel.Last month, ET reported Google’s intentions to export mobile phones from India.Arvind Vice Chairman Puneet Lalbhai admitted that some ‘strategic customers’ experienced increased costs, which the company partially absorbed, which potentially affects margins in Q1 and Q2.Nevertheless, Lalbhai mentioned an increase in order from American customers.He expressed confidence that the margin would be stable, will become clear in the latter half of the financial year with benefits, supported by strong demand. He said, “This year we should add an increase in the amount of significant costumes in textile space compared to last year. Many of our abilities we are investing now on stream … temporary margin headwind, but very optimistic development and demand outlook,” he said.Also read Apple’s largest contract maker Foxconn has read 300 acres iPhone making campus in India with DEMM for 30,000 employees.In his presentation for investors, Gokaldas Exports highlighted that despite temporary failures, Chinese tariffs and Bangladesh’s political instability increases India’s appeal as a source hub.Tata Consumer Products CEO Sunil D’Suza said that the competitive landscape remains balanced for all players such as coffee and tea, such as coffee and tea.The first shipment of the India-made air conditioner of Havells has reached the US, in which the management has expressed confidence of benefiting from American BTA in India. Leaders of Bluestar and Amber Enterprises report significant export interest as businesses are prepared for potential tariff changes.R Kuruvilla Marx, the International Trade CEO of Titan Company, indicated that they are monitoring the US price competition and expect Swift BTA implementation.Also read Explained: Why India is well deployed to deal with Trump’s tariff and negative effects of top causes