5.5 million percent returns since 1964, S&P 500 to 140 times! Why there will be no other investor like Warren Buffett

Warren Buffett’s life is a masterclass in how to invest. There is no other investor like him, and it is doubtful whether there will ever be an investor who can match the track record of experienced.

On Saturday, the CEO of Berkshire Hathaway announced that he would retire by the end of 2025, by handing over reins to Greg Abel. Buffett’s announcement surprised everyone.

Buffett’s remarkable investment achievements are unmatched in financial history. His extraordinary performance as an investor remains unique, setting a benchmark that appears to be inaccessible for future generations.

While many people discuss how life experiences affect investment decisions, Buffett has demonstrated a unique ability to integrate investment principles into everyday existence.

Buffett, among the world’s richest individuals and the most successful investors, assumed Berkshire Hathway in 1965, while it was operated as a textile manufacturing firm. He converted the organization into a diverse venture, receiving underwellood companies and shares.

His extraordinary investment Acumen brought him to the mythological position on Wall Street. The skills led his monkey “Oracle of Omaha”, accepted his birthplace and chose a hometown in Nebraska where he resides and does business.

Also read Warren Buffett to hand over the reins to Greg Abel: Top 10 things to learn about Orackal of Omaha’s Heir in Berkshire Hathaway

5,502,284% return!

Buffett has always avoided methods of complex financial instruments and aggressive corporate acquisitions, rather than focusing on continuous, long -term investment strategies instead.

Their permanent achievement remains a group with Berkshire Hathaway, Nebraska-Mukhyalaya, owned by various businesses, including Duracell Battery, Geoico Insurance, Paint Manufacturer and Diamond companies.

The organization maintains strategically selected shareholding in major American corporations including Coca-Cola and Chevron.

As stated by Forbes magazine’s real-time wealth tracker on Saturday, Warren Buffett’s money is $ 168.2 billion, which reflects him as the fifth rich person in the world.

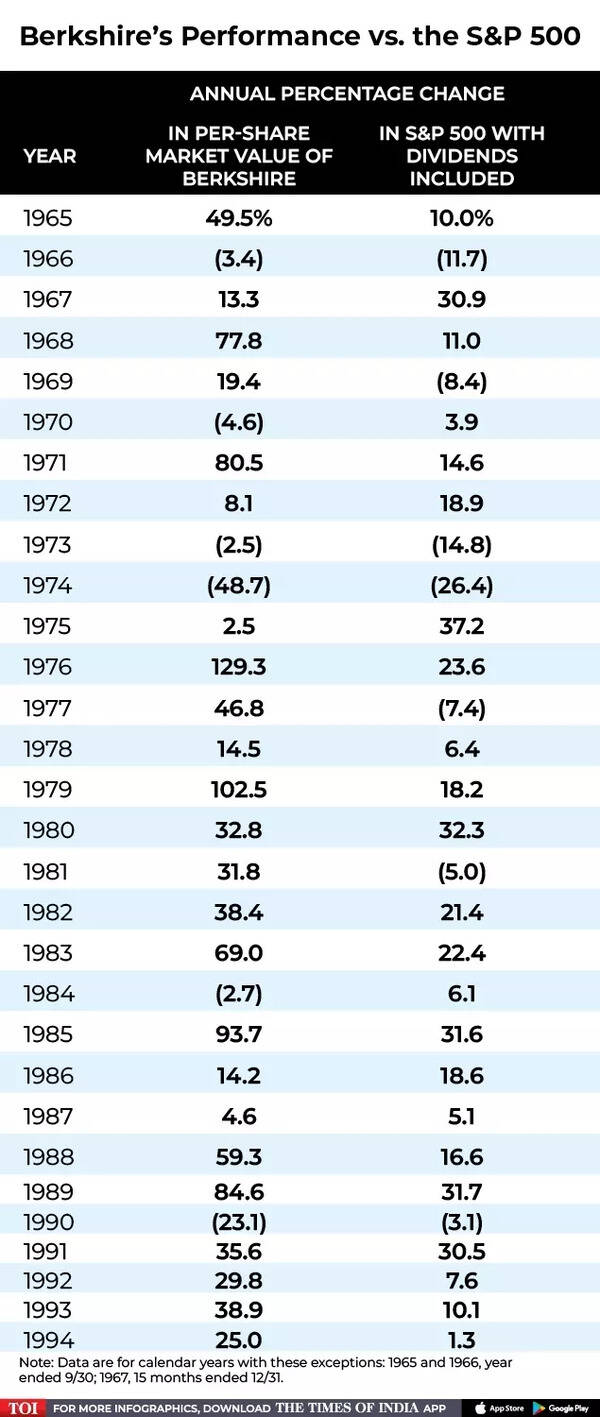

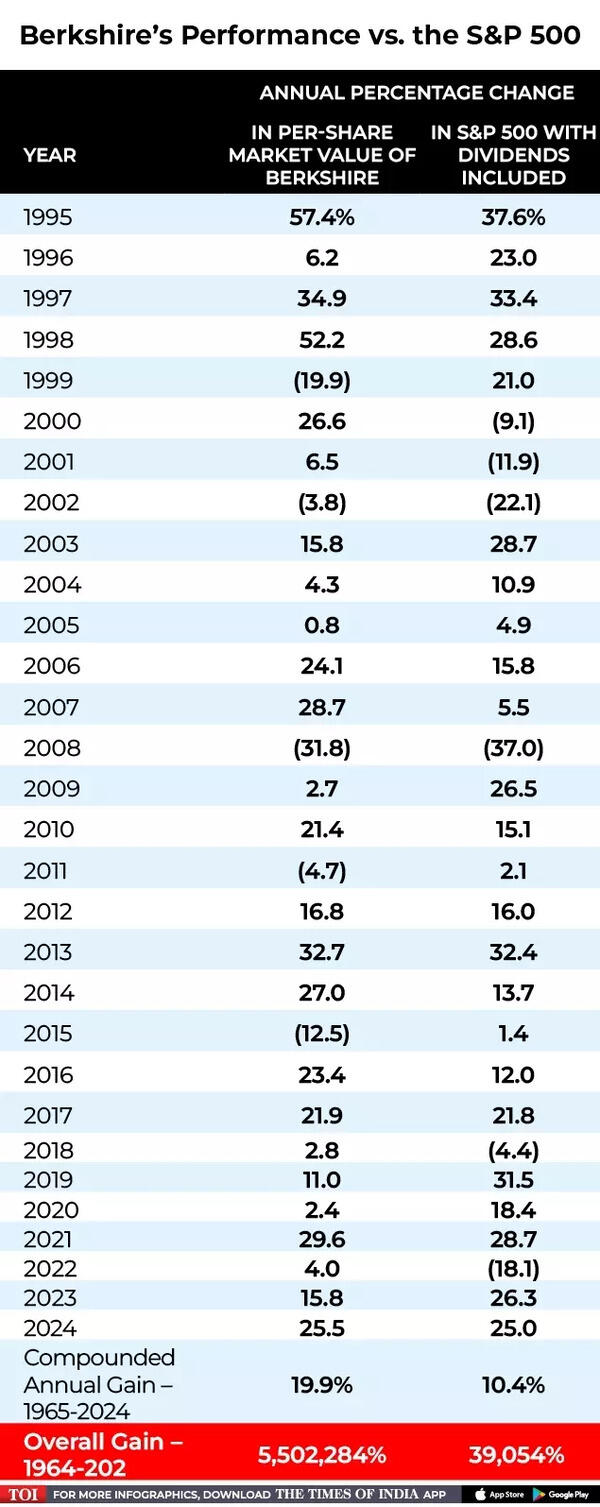

From 1964 to 2024, if someone was comparing Berkshire’s performance with S&P 500 – East has received 5,502,284%! As the number appears (it is 5.5 million percent!) As is desperate – this is true! On the other hand S&P 500 has given 39,054%. This is according to the data shared in the annual 2024 letter of Warren Buffett to the shareholders in February this year.

Berkshire vs S&P 500

Berkshire vs S&P 500 Return

So basically, Berkshire Hathaway has improved the S&P500 more than 140 times!

During the 1950s, Buffett worked on Wall Street and founded the Buffett Partnership, which was later combined with Berkshire Hathaway in 1965.

As an enthusiastic reader of financial publications and other materials, Buffett focused on investments that they evaluated, until they became profitable, maintained their positions.

He developed Berkshire into a diverse group recognized for investing in fundamental fields including energy, banking, air travel and food. Portfolio includes bets in Citigroup, Croger, Apple and American Express.

He managed Berkshire with his long -term vice -president Charlie Munger, who was six years older than him.

Also read Warren Buffet, the 5th richest person in the world, is priced at $ 169 billion: There is a look at his investment here

Warren Buffett’s Best Investment

Apple: Do you know that Buffett has maintained its reluctance to invest in technology firms, citing limited understanding of their evaluation and long -term viability?

However, he created an exception in 2016 when he began to receive Apple’s shares. His argument to invest more than $ 31 billion was based on his perception of Apple as a consumer commodity company, who took over the command of extraordinary customer loyalty. Investment proved to be extremely profitable, with its value, it was over $ 174 billion before the sale of Holdings of Berkshire Hathway from Buffett with its value.

National Compensation and National Fire and Marine: Acquired in 1967, these firms marked Buffett’s initial ventures in insurance. Insurance float – premiums received before claim settlement – served as investment capital for several Berkshire Ventures, which contributes significantly to the expansion of the organization. The insurance segment has since included JioCo, general reinser and additional insurers. By the end of the first quarter, the float reached $ 173 billion.

Strategic investment in American Express, Coca-Cola Company and Bank of America During the period, these companies faced challenges due to disputes or market conditions. These shareholding appreciated more than $ 100 billion from their procurement price, except for adequate dividend income accumulated over time.

Humble start of Warren Buffett

- Born on 30 August 1930 as the second of the three children, Buffett developed an initial interest in business after reading “One thousand ways to make $ 1,000” during his boyhood.

- Buffett saw a challenging childhood. She passed through the shopkeeper’s period and had to deal with her mother Leela’s derogatory behavior, calling her sister Doris “stupid”.

- Although he considered closing his education, his father, who worked as a businessman and served as a Congressman, stopped him from doing so.

- He initially studied at the University of Pennsylvania before going to Nebraska University, where he completed his professional degree.

- Subsequently, he earned a master’s degree in Economics from Columbia University in New York in 1951.

‘Omaha ki’ simple lifestyle and philanthropy

Despite its immense wealth, Buffett maintains a specificly modest lifestyle, which avoids specific activities of ultra-tortoise individuals, such as collecting expensive artwork or owning many magnificent qualities globally.

His residence is the same modest house in a peaceful Omaha suburb, purchased in $ 31,500 in 1958.

Their daily dietary preferences are particularly simple, including McDonald’s Chicken Mcnagates three times weekly, potato chips for snacking, ice cream in the form of sweets and about five cans of Coca-Cola.

For the holiday, he enjoys playing the bridge and kills Ukalule.

In 2006, Buffett admitted to owning a private aircraft, stating that he simplified his lifestyle. In the same year, he promised to give 99 percent of his money to charitable reasons.

Along with his bridge partner Bill Gates, Buffett successfully encouraged other billionaires to commit at least half the fortune.

These philanthropist initiatives have earned a widespread appreciation in the American Society, attracting several small investors for the annual spring gathering of Berkshire in Omaha, an event known as “Woodstock for Capitalists”.

As the world’s most famous and intelligent investor Berkshire comes out of the role of Hathway, investors from all over the world will continue to take maximum advantage of their timeless investment mantras.